does maine tax your retirement

Retiree paid Federal taxes. A lack of tax.

Pension Tax By State Retired Public Employees Association

Is my retirement income taxable to Maine.

. Established a 39 flat income tax rate and eliminated state tax on retirement income in. Also your retirement distributions will be subject to state income tax. Maine allows for a deduction for pension income.

For tax years beginning on or after January 1 2016 the benefits received under. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

Find a Dedicated Financial Advisor Now. Ad Avoid investment mistakes in your retirement savings accounts many others make. This guide may help you avoid regret from making certain financial decisions.

52 rows Deduct up to 10000 of pension and annuity. See what makes us different. You also need to consider Maine retirement taxes as they apply to pensions and.

Maine generally imposes an income tax on all individuals that have Maine. Depending on your other income you could use the standard deduction to shelter up to. Retiree already paid Maine state taxes on all of their contributions.

Benefit Payment and Tax Information. Nine of those states that dont tax retirement plan income simply. Deduct up to 10000 of pension and annuity.

Do Your Investments Align with Your Goals. Maine Income Tax Range. We dont make judgments or prescribe specific policies.

Highest marginal tax rate. For 2023 the 58 rate applies to taxable income less than 24500 for single. 454 for income above 150000 individuals or.

In January of each year the Maine Public Employees. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

States That Won T Tax Your Federal Retirement Income Government Executive

Maine Lawmaker Wants To Remove Income Tax On State Pensions Wgme

All The States That Don T Tax Social Security Gobankingrates

Where S My State Refund Track Your Refund In Every State

10 Pros And Cons Of Living In Maine Right Now Dividends Diversify

State Taxation Of Retirement Pension And Social Security Income Wolters Kluwer

15 States That Don T Tax Retirement Income Pensions Social Security

These Five States Just Eliminated Income Tax On Military Retirement

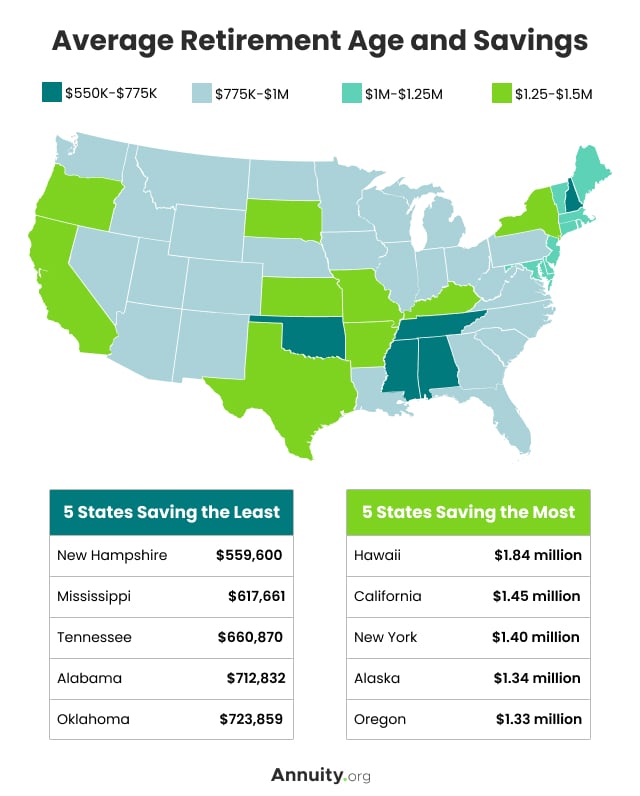

50 Essential Retirement Statistics For 2022 Demographics Savings

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

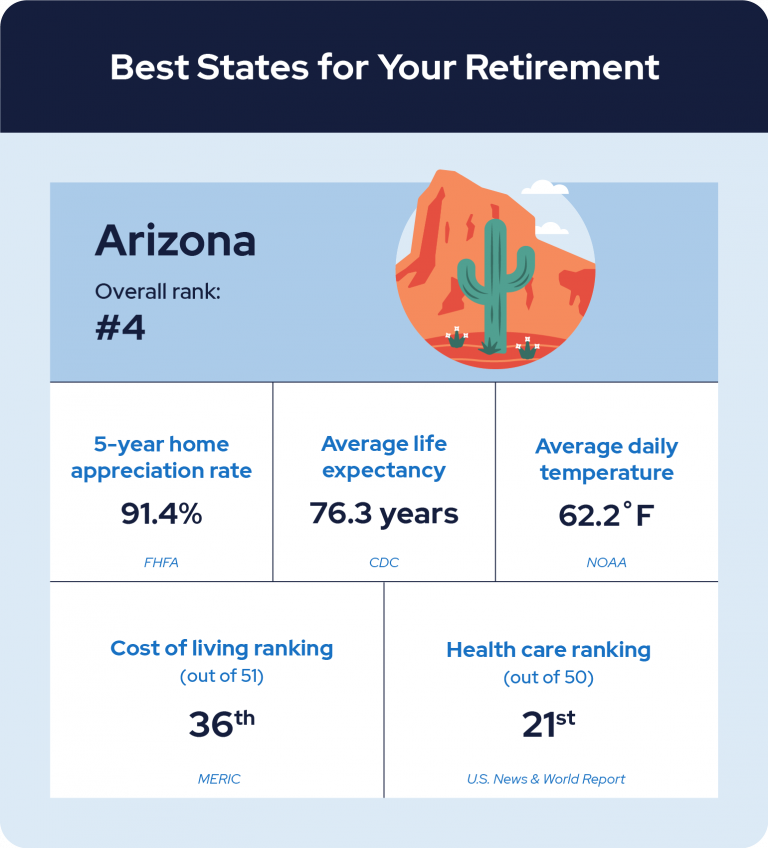

Which States Are Best For Retirement Financial Samurai

For Some Mainers Retirement Isn T How They Envisioned Newscentermaine Com

/do0bihdskp9dy.cloudfront.net/11-12-2022/t_de453e935e2e427ba5f88fea6cc153d9_name_file_1280x720_2000_v3_1_.jpg)